Make a Pawsitive Impact with the Arizona Charitable Tax Credit 🐾💙

MEET YOUR CFO

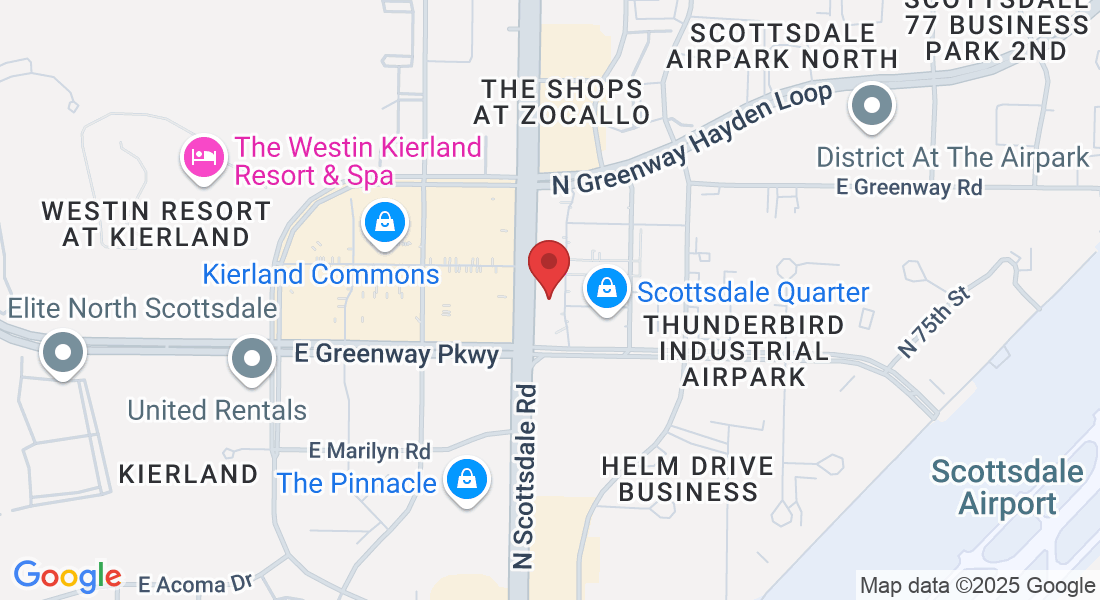

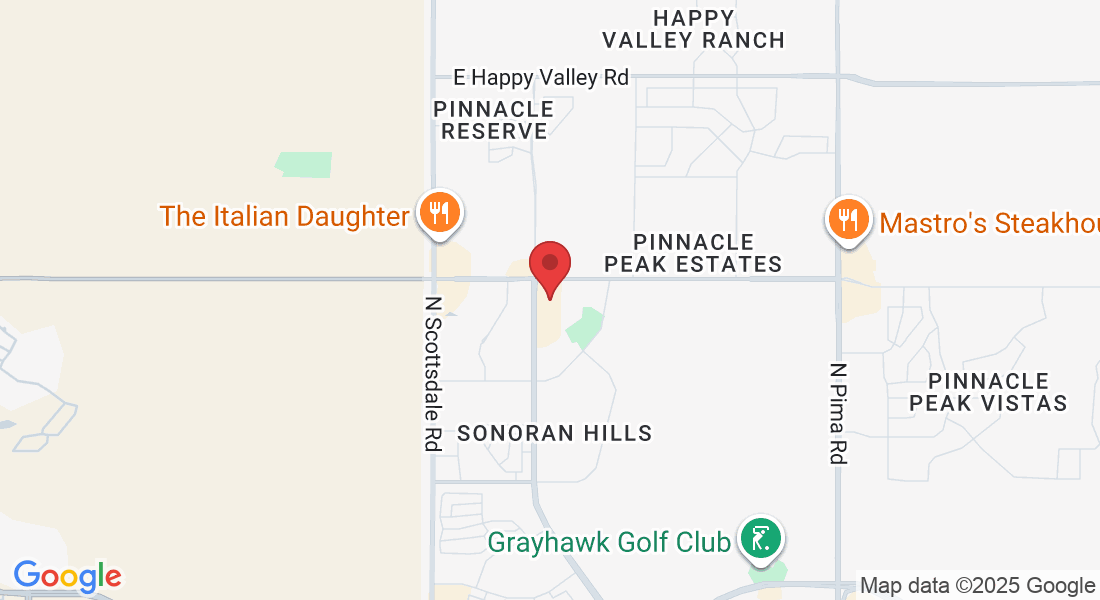

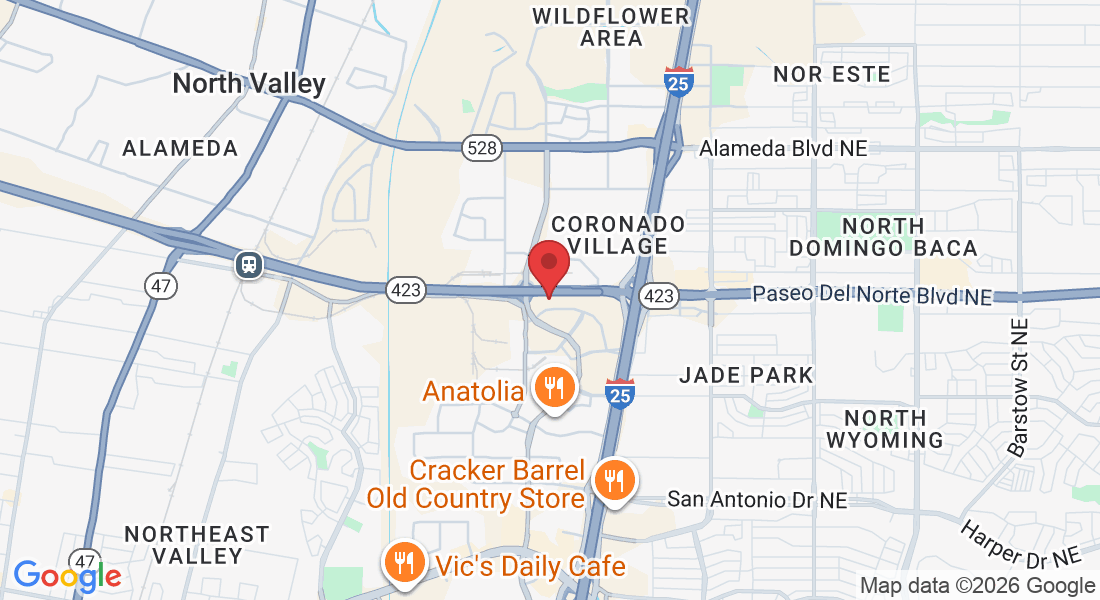

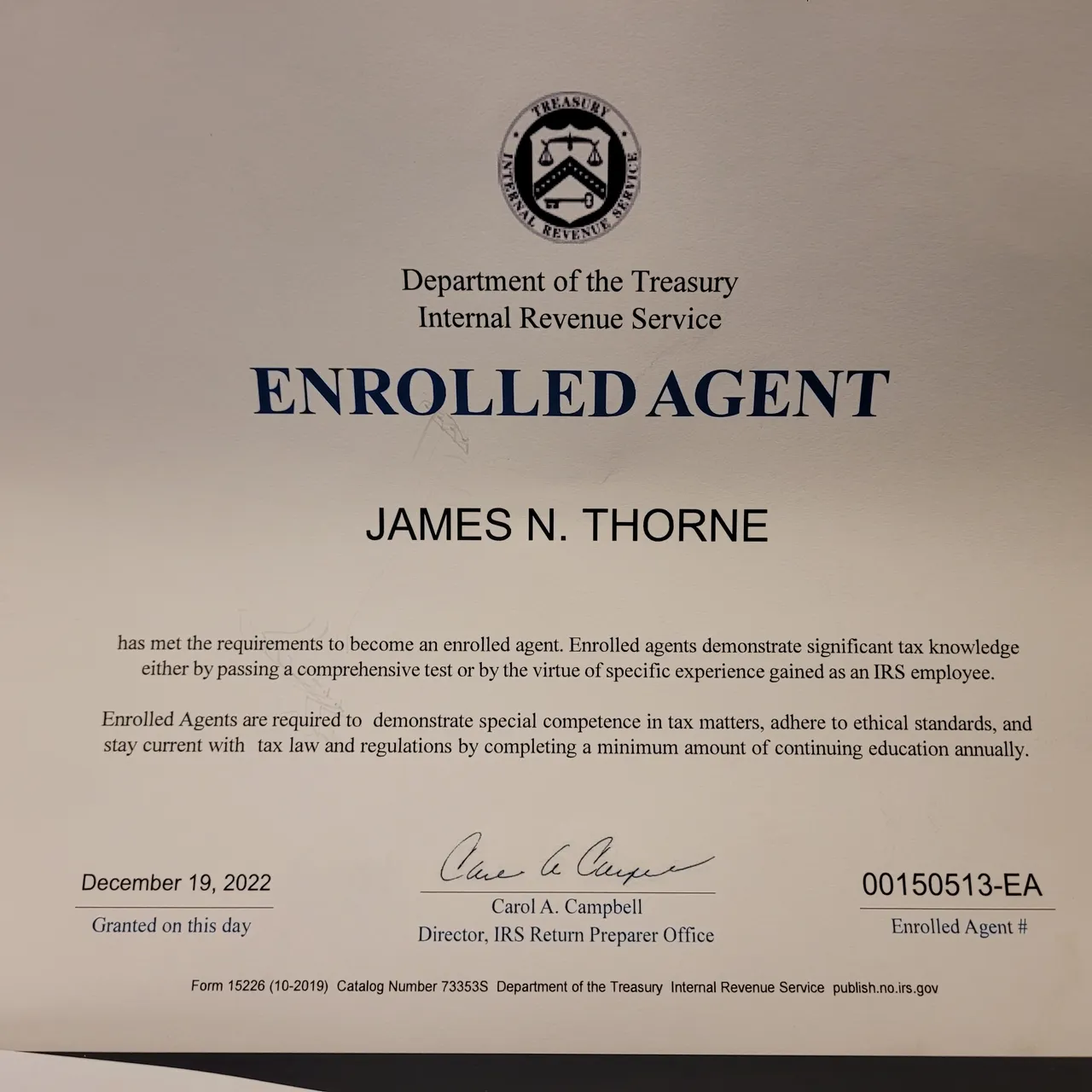

Nate Thorne EA, CFO on Call's - Managing Member and Founder, RamseyTrusted Tax Pro and has over 28 years of overseeing the financial well-being of companies ranging from start-ups to established multi-million dollar corporations, working as a Chief Financial Officer, Division Controller, International Controller, and Accounting Manager.

HOW I CAN HELP YOU

BUSINESS FINANCIAL SERVICES

Bookkeeping: Manage daily transactions to keep your financial records accurate and up-to-date.

Payroll: Efficient management of payroll and taxes, ensuring compliance and timely payments.

Planning: Providing insightful reports and advice to support your business growth.

TAX PREPARATION AND COMPLIANCE

Tax Service: Comprehensive tax preparation for personal, business, and corporate need.

Sales Tax Expertise: Knowledgeable in local sales tax and VAT regulations to keep your business compliant.

Corporate Documentation: Assistance with legally required corporate documentation.

TAX ADVISORY AND REPRESENTATION

Enrolled Agent: Authorized representation before the IRS, offering peace of mind during audits or disputes.

Reporting: Helping directors and managers make informed decisions with clear, detailed reports.

Capital Fundraising: Expert advice on seeking equity and raising capital to fuel your business growth.

FAQS

When should I contact an accountant?

As soon as you start to think about your business, an accountant can help you take the next steps. We can discuss your business's organization, tax purposes and operations, along with target pricing and profit margins.

What are my options for raising money?

Get some impartial advice from an accountant before you consult the bank. A bank will want to see a strong business plan and organized records. Let us help you get ready for your business's next step!

How can I know which accountant is right for me?

Does your accountant return your calls? Do you feel comfortable asking them a question? Do you feel heard? With the right accountant, the answers should be a resounding "Yes!"

What is an Enrolled Agent (E.A)?

Enrolled agents (EAs) are America’s Tax Experts®. They are the only federally-licensed tax practitioners who both specialize in taxation and have unlimited rights to represent taxpayers before the Internal Revenue Service. These tax specialists have earned the privilege of representing taxpayers before the IRS by either passing a three-part examination covering individual tax returns; business tax returns; and representation, practice and procedure, or through relevant experience as a former IRS employee. All candidates are subjected to a rigorous background check conducted by the IRS.

Drop us a line!

We know that the accounting needs for each business or family are unique. Use our form to tell us more about your needs and concerns, and we will give you a complimentary quote on tax preparation services or one-time accounting services.

Copyright© 2025 Nate the CFO - All Rights Reserved.